South African Gas Market

Shallow Well Gas

An Energy Market in Crisis

South Africa’s Number One Priority Issue

South Africa is in the midst of an energy crisis, with rolling blackouts for many hours of each and every day. The South African Government recognises the energy the crisis as South Africa’s number one priority issue. With 85% of power being generated by ageing coal-fired power stations, many of which are facing closure due to end of life and the depletion of nearby coal resources, the need for immediate, cleaner, low cost energy is paramount to the future prosperity of South Africa.

Strategically Located Resource

In Position to Take Advantage of Favourable Gas Market Dynamics

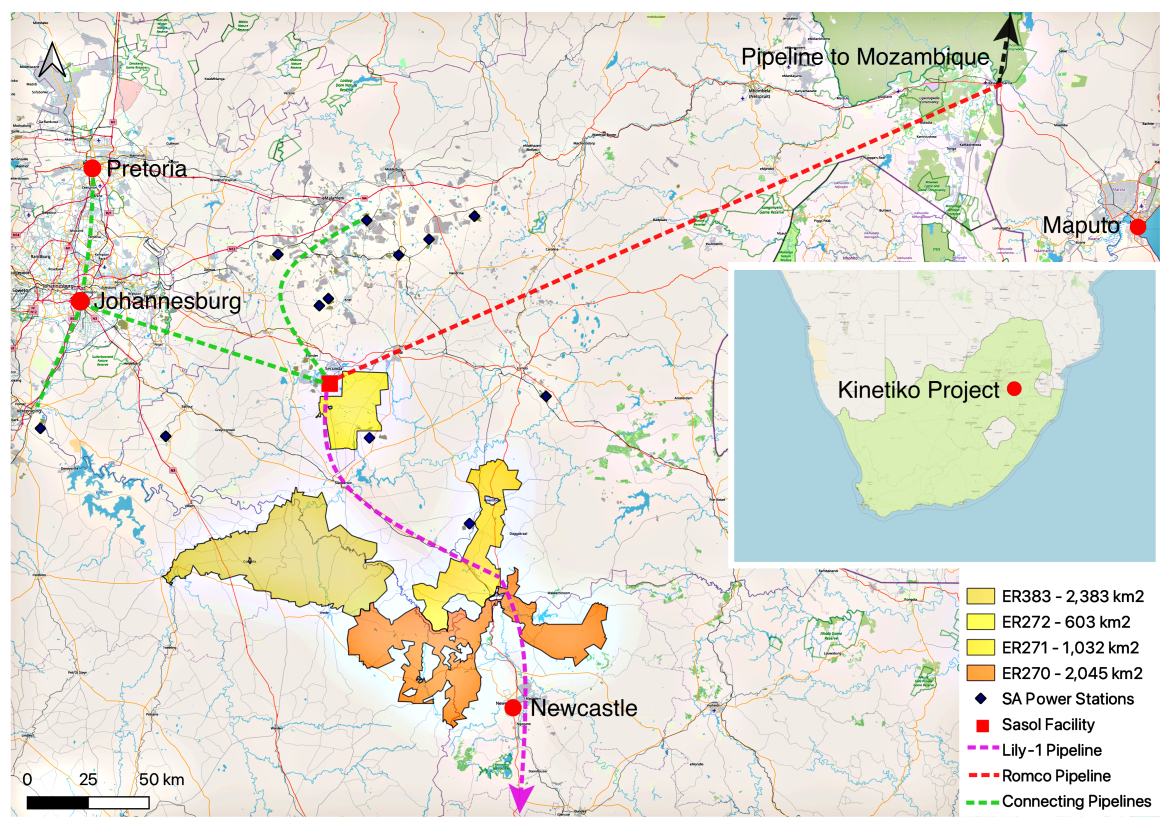

The project is strategically located in a region characterised by its gas market dynamics:

- Existing infrastructure, power generation, gas pipelines, high voltage transmission lines, road and rail

- Very high energy demand be it gas for power generation, transportation fuels, thermal industry or mining applications.

- Uniform geology

- 100% drilling success with large pay zones typically in excess of 100m.

The vast gas resources located on Kinetiko’s tenements will support multiple individual gas production developments, and are strategically located at the heart of South Africa’s energy, mining and transport infrastructure and close to the major population centres of Johannesburg and Tshwane (Pretoria). Benefits of operation in this specific location include:

- Growing demand for energy in South Africa is being met with shortages.

- Government support and regulatory measures to prioritise the domestic gas sector.

- Current constraints on imports and new exploration rights limits the competition.

Consequently, commercialisation scenarios for Kinetiko’s gas are varied in both nature and scale. However, a common factor for all scenarios is a growing need for energy in all forms in South Africa.

There is now strong government support for gas as documented in the Integrated Resources Plan 2023, which calls for over 7,2 GW from gas over two horizons. This plan has a specific focus on the energy sector, prioritising the development of not only renewables (currently transmission choked) but also a domestic gas sector with upstream and downstream developments.

This situation gives Kinetiko Energy a clear advantage and reduces competition for potential gas supplies.

Regulatory measures are attempting to diversify energy demand to overcome increasing shortages in particular sectors like electrical power.

Demands for all forms of energy are growing throughout sub-Saharan Africa. The South African parastatal electrical generator and transmission company Eskom has in recent years been finding it increasingly difficult to meet peak demands of the countries that constitute the Southern African Power Pool, including South Africa.

Eskom not only faces considerable challenges in financing and building new generating and transmission capacity but has also had issues with supply of coal to its power stations.

Energy input demand is further growing in the region for industrial usage, petrochemicals manufacturing, fertilisers and transport fuels.

Kinetiko Energy Project & Infrastructure Map

Coal Trucks Heading to the Majuba Power Station

Gas price assumption

South Africa Has Some of the Highest Gas Prices in the World

High value markets with regulator-approved maximum prices, among the highest globally.

The existing markets in the Newcastle, Durban, Amersfoort, Ermelo, Volksrust and manufacturing and transportation centres of the Johannesburg metropolis and surrounding areas mainly comprise coal, HFO, Petrol, Paraffin, LPG, diesel and waxy oil users.

Regulated maximum prices for these energy products have dramatically changed over recent years, making the identified markets high in value.

The current approved maximum retail prices for gas traders set by the National Energy Regulator of South Africa (NERSA) range between 8-13US$/GJ, some of the highest gas prices for domestic markets anywhere in the world.

The gas price assumption is conservative in the context of the South Africa energy crisis. The current minimal supplies of locally produced natural gas have seen spot prices around 20US$/GJ. With daily rolling blackouts, South African homes and business rely on diesel burning generators to maintain power supply. The equivalent cost of this inefficient but necessary supply is approximately 35US$/GJ.

Infrastructure and Commercialisation

Located in Close Proximity to Key Infrastructure

Strategically located amid existing, high-quality infrastructure, presenting a range of attractive potential strategies for commercialisation

Due to the location of the Kinetiko Energy Amersfoort Project and granted Exploration Rights, this potential energy project sits amid multiple infrastructure resources that will facilitate commercialisation of the project.

Potential commercialisation scenarios for Amersfoort include but are not limited to:

Gas sales into the existing coal powered generation plants for flame control and ultimately for full co-generation. The Majuba Power Station, a 4,110MW coal-fired facility, is located within sight of the Amersfoort Project. Majuba requires around 50,000t of coal a day, which is currently transported by truck and railway from various sources in the Mpumalanga coal fields. In addition to Majuba there are 10 additional power stations within 300km all utilising the existing high voltage power infrastructure, with capacity to add substantial GTP generation.

- Gas supply into the existing gas transmission (Transnet’s Lily-1 pipeline) and distribution network in Newcastle, Richard’s Bay and Durban.

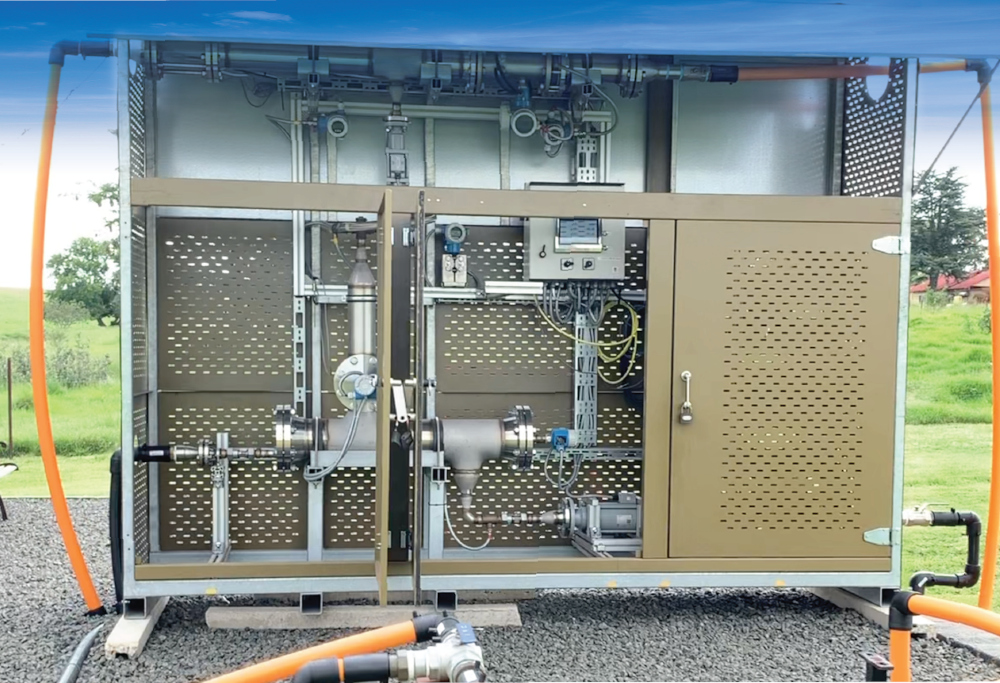

- Independent Power Production (IPP) either grid coupled or direct to a major customer such a local mine or manufacturing facility. SS-LNG interfaced IPP for peak load and distributed demand.

- CNG production, distribution and transport networks already exist in South Africa. These virtual pipelines utilise rail and road to supply gas to manufacturing customers, fleet transport depots, mining and domestic end users. The operators of this capacity, (with whom we have relationships) are able to obtain all necessary permitting from NERSA to transport CNG produced from our fields.

Kinetiko Energy has commenced discussions with a range of potential customers and government agencies charged with infrastructure development and national energy security matters and has received several Expressions of Interest from key potential off takers and downstream demand. This demand driven enquiry is driving the development of the production strategy now in place.